Sourcing display components is one of the most critical tasks for electronics engineers and procurement managers. The display is the face of the product. If it fails, the entire device is perceived as broken. Choosing the right partner is not just about finding the lowest price; it is about finding a vendor who understands the intricacies of glass, controllers, and supply chain stability. An experienced LCD manufacturer does more than assemble parts; they act as a technical consultant to ensure the display survives the product's intended environment.

The market is flooded with traders and middlemen, making it difficult to distinguish a factory with genuine R&D capabilities from a simple reseller. For industrial, medical, and automotive applications, the distinction is vital. This article breaks down the criteria for evaluating a display partner, from technical competencies to lifecycle management, and explains why companies like Chuanhang Display are becoming go-to sources for demanding projects.

When you start vetting suppliers, the first step is to assess their manufacturing scope. Not every supplier creates the glass substrate itself. In fact, most module manufacturers purchase the "cell" (the glass with liquid crystal) from major panel makers and then perform the bonding, backlight assembly, and PCB design. This is known as LCM (Liquid Crystal Module) manufacturing.

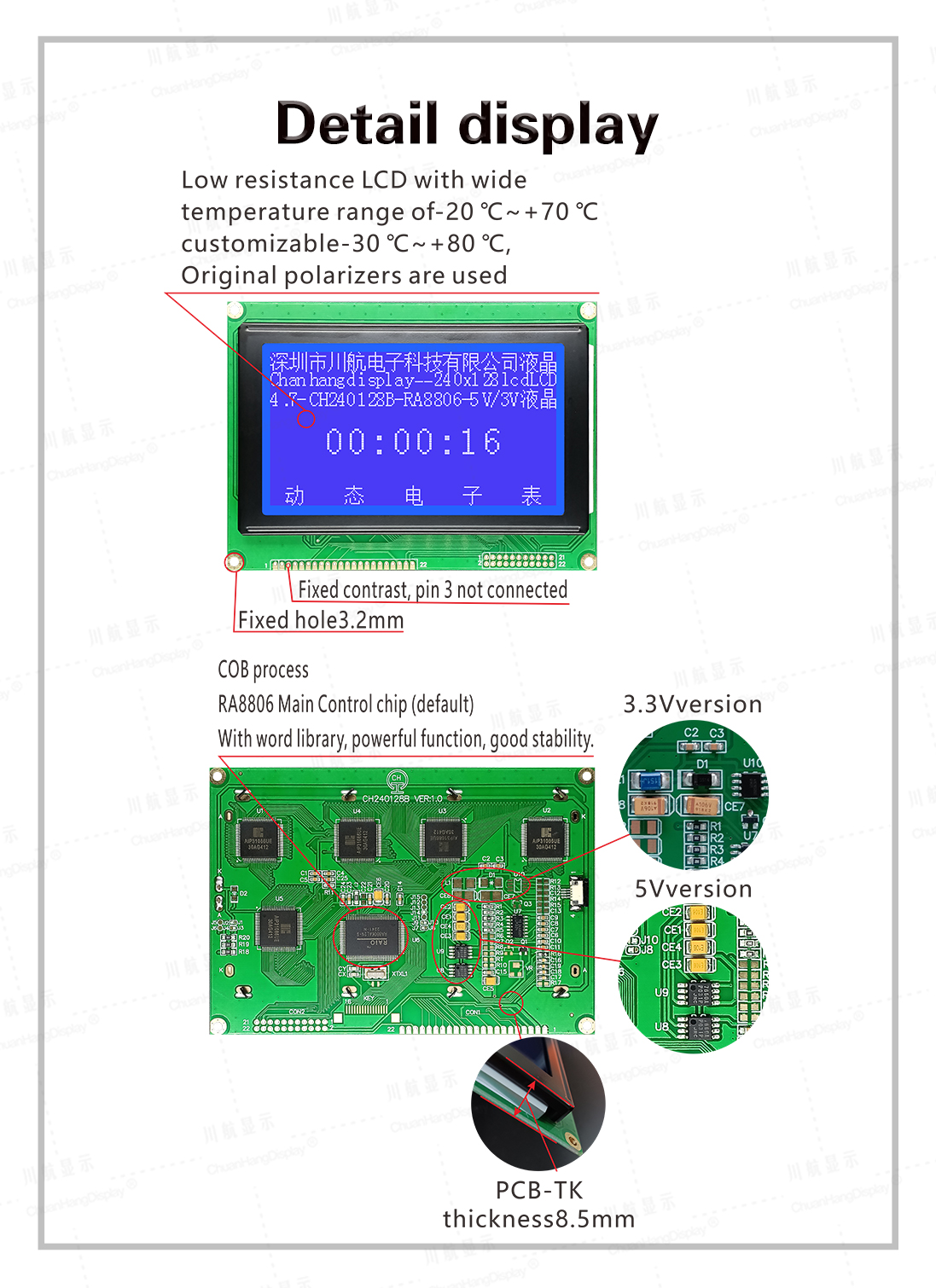

A capable LCD manufacturer excels in the backend process. This involves Chip-on-Glass (COG) bonding, where the driver IC is attached directly to the glass. This process requires precise automated machinery. If a factory relies on manual bonding for fine-pitch connections, reliability issues will likely surface later.

Another key capability is backlight customization. The brightness of a display, measured in nits, is determined by the backlight unit. A manufacturer must have the ability to design custom light guide plates and select specific LED bins. This ensures that a display meant for outdoor use achieves high brightness, while a medical display maintains consistent color uniformity.

Your supplier must offer a portfolio that matches your specific needs. A factory focused solely on high-end smartphone screens may not be interested in producing a low-volume monochrome display for a thermostat. Conversely, a manufacturer specializing in legacy monochrome screens might lack the equipment for modern color interfaces.

For industrial meters, TN (Twisted Nematic) and STN (Super Twisted Nematic) screens are still dominant due to their low power consumption and high contrast. A specialized LCD manufacturer like Chuanhang Display understands how to optimize these older technologies. They can adjust fluid types to widen the operating temperature range, ensuring the screen doesn't turn black in direct sunlight or freeze in sub-zero storage.

For color interfaces, Thin Film Transistor (TFT) technology is standard. However, viewing angles vary significantly. A top-tier manufacturer will offer IPS (In-Plane Switching) options, which allow the screen to be viewed from any angle without color inversion. Understanding the source of these panels is crucial. Manufacturers should be transparent about which generation of glass lines they are sourcing from to guarantee long-term availability.

A datasheet can promise excellent specifications, but only a rigorous quality control (QC) process can deliver them. When visiting or auditing an LCD manufacturer, pay attention to their testing equipment. It is not enough to simply power on the display and check for dead pixels.

Environmental testing is mandatory. The manufacturer should have chambers for high-temperature and high-humidity storage. This stresses the polarizers and the adhesive layers. Inferior adhesives will bubble or delaminate after a few hundred hours in a heat chamber. Reliable suppliers run these tests on every new batch of raw materials.

ESD (Electrostatic Discharge) testing is another filter. Display drivers are sensitive to static. A factory with poor ESD controls on the production floor will produce units that suffer from "latent failure." The display might work during final inspection but fail weeks after the customer receives it. Professional factories have grounded flooring, ionized air blowers, and strict handling protocols.

One of the main reasons to work directly with a manufacturer rather than a distributor is the ability to customize. "Off-the-shelf" standard products rarely fit a new housing design perfectly. The FPC (Flexible Printed Circuit) is the most common customization point.

You might need the FPC to be longer, bent at a specific angle, or designed with a specific connector to match your mainboard. An agile LCD manufacturer can redesign the FPC layout in a matter of days. This flexibility allows your mechanical engineers to optimize the internal space of your device without being constrained by the display's connection point.

Customization also extends to the interface. While SPI and I2C are common for small screens, larger TFTs might require RGB, LVDS, or MIPI interfaces. A skilled engineering team at the factory can help bridge these gaps, sometimes suggesting controller ICs that simplify the software development on the host side.

In the crowded landscape of Shenzhen's electronics market, Chuanhang Display (Shenzhen Chuanhang Electronic Technology Co., Ltd.) has carved out a reputation for stability and technical depth. Rather than chasing the lowest possible cost at the expense of quality, Chuanhang focuses on the industrial and medical sectors where reliability is paramount.

Chuanhang Display offers a balanced portfolio. They support legacy 12864 and character modules, which ensures that older industrial designs can stay in production. Simultaneously, they invest in modern TFT and touch panel integration. Their ability to bond capacitive touch screens (PCAP) to LCDs using optical bonding results in better clarity and durability, a feature highly sought after in modern HMI (Human Machine Interface) applications.

Their approach to "End of Life" (EOL) management is also a distinguishing factor. A common fear for procurement managers is that a controller IC goes obsolete. Chuanhang works proactively to identify drop-in replacements, minimizing the disruption to their customers' production lines.

Price is always a factor, but the cost structure of an LCD is complex. The glass panel, the driver IC, the backlight LEDs, and the FPC all fluctuate in price based on global demand. A strategic LCD manufacturer maintains good relationships with semiconductor foundries to secure driver ICs even during shortages.

When negotiating, understand the NRE (Non-Recurring Engineering) costs. If you request a custom size or a custom icon segment display, there will be a tooling fee. However, for many standard resolutions, the manufacturer likely already owns the tooling. Companies like Chuanhang Display are often transparent about these costs, helping startups and mid-sized companies launch products without prohibitive upfront fees.

MOQ (Minimum Order Quantity) is the final hurdle. Large Tier-1 factories often ignore orders under 10,000 units. Flexible manufacturers are willing to grow with the client, accepting smaller pilot runs of 500 or 1,000 units. This support during the ramp-up phase is invaluable for new product introductions.

Modern user interfaces increasingly demand touch capabilities. Historically, the LCD and the touch panel were sourced from different vendors and assembled by the final integrator. This often led to dust getting trapped between the layers and poor optical performance.

Today, the preferred model is to source a fully integrated module from a single LCD manufacturer. They perform the lamination of the touch sensor to the display in a cleanroom environment. This "One-Stop Solution" reduces the vendor list and simplifies warranty claims. If the touch function fails, there is no finger-pointing between the glass vendor and the touch vendor.

Resistive touch is still used for gloved operation and heavy industrial environments, while capacitive touch is standard for consumer-like experiences. Ensure your manufacturer has expertise in tuning the touch controller firmware. Water rejection and noise immunity (from motors or power supplies) are critical firmware settings that inexperienced suppliers often overlook.

Global logistics have become volatile. A manufacturer located near major logistics hubs like Shenzhen or Hong Kong offers a distinct advantage in shipping speed. However, production lead time is the real metric to watch. Standard lead times for LCDs are typically 4 to 6 weeks. Custom displays may take 8 to 12 weeks for the first batch due to tooling.

Ask your potential supplier about their buffer stock policy. Will they hold inventory for you? A partner like Chuanhang Display often works with long-term clients to keep a safety stock of critical components, shielding the production line from sudden market spikes or transport delays.

Selecting the right LCD manufacturer is a strategic decision that impacts your product's quality, cost, and longevity. It requires looking beyond the PDF datasheet and understanding the factory's process controls, supply chain strength, and engineering mindset. A display is a complex sandwich of glass, silicon, chemicals, and light; only a competent manufacturer can ensure these elements work in harmony for years.

For businesses seeking a balance of industrial robustness and flexible service, Chuanhang Display represents the ideal tier of supplier. They possess the technical capability to handle complex integration while maintaining the agility to support custom requirements. By prioritizing quality components and transparent communication, they help engineers bring reliable visual interfaces to the world.

Q1: What is the typical Minimum Order Quantity (MOQ) for a custom LCD manufacturer?

A1: MOQs vary significantly by technology. For standard modules, suppliers like Chuanhang Display might accept orders as low as 100 units. However, for fully custom glass panels (custom size or icons), the MOQ is typically higher, often around 1,000 to 5,000 units, to justify the tooling and setup costs of the production line.

Q2: How does an LCD manufacturer handle "End of Life" (EOL) components?

A2: A responsible manufacturer monitors the status of key components like driver ICs and glass panels. If a part is scheduled to be discontinued, they will issue an EOL notice, usually 6 to 12 months in advance. They should also propose a "Last Time Buy" option or engineer a compatible replacement module to ensure your product can continue production without major redesigns.

Q3: What is the difference between COB and COG construction?

A3: COB (Chip on Board) mounts the controller IC on the PCB, connecting it to the glass via wires or zebra strips. It is bulky but robust and easy to mount. COG (Chip on Glass) mounts the IC directly onto the glass ledge. COG is much thinner, lighter, and cheaper for high volumes, making it the standard for modern handheld devices and compact electronics.

Q4: Can a manufacturer improve the readability of an LCD in direct sunlight?

A4: Yes. Manufacturers can use transflective polarizers, which reflect ambient light to boost visibility. Alternatively, they can increase the brightness of the LED backlight (high-nits) or use optical bonding to eliminate the air gap between the cover glass and the display. This reduces internal reflections and significantly improves contrast outdoors.

Q5: Why do I need to pay NRE charges to an LCD manufacturer?

A5: NRE (Non-Recurring Engineering) charges cover the one-time costs of setting up production for a custom item. This includes creating photomasks for the glass etching, designing the PCB or FPC, and building test jigs. Once paid, you generally own the rights to that specific design, and future orders will only be charged the unit price.